How to Avoid Medicare Late Enrollment Penalties

Kent A. Bennett & Associates Guides You Through Timely Medicare Enrollment Missing your Medicare enrollment window can lead to costly lifetime penalties. At Kent A. Bennett & Associates in Montoursville, PA, we help you understand deadlines, avoid mistakes, and enroll in time to protect your budget. Know the Enrollment Periods That Impact Your Medicare Costs […]

Can You Live Off Social Security

Kent A. Bennett & Associates on the Reality of Social Security Can you live off Social Security? When you picture your retirement, do you imagine yourself comfortably relaxing on a beach, or are you more concerned about making ends meet? Social Security is often seen as a lifeline for retirees, but with the rising cost […]

Knowing When to Retire

Prepare for Retirement with Kent A. Bennett & Associates Knowing when to retire is an important decision, and planning for retirement can be exciting and daunting. Many factors determine whether you’re financially ready to leave the workforce. These key considerations can help you determine if you have enough resources to retire comfortably. Assess Your Nest […]

Nursing Home Insurance

Protect Your Financial Future with Kent A. Bennett & Associates Nursing home insurance, also known as long-term care insurance, is a safeguard against the significant costs associated with extended care facilities. By investing in this policy, you’re not just protecting your assets; you’re ensuring a higher quality of life in your later years. The Rising […]

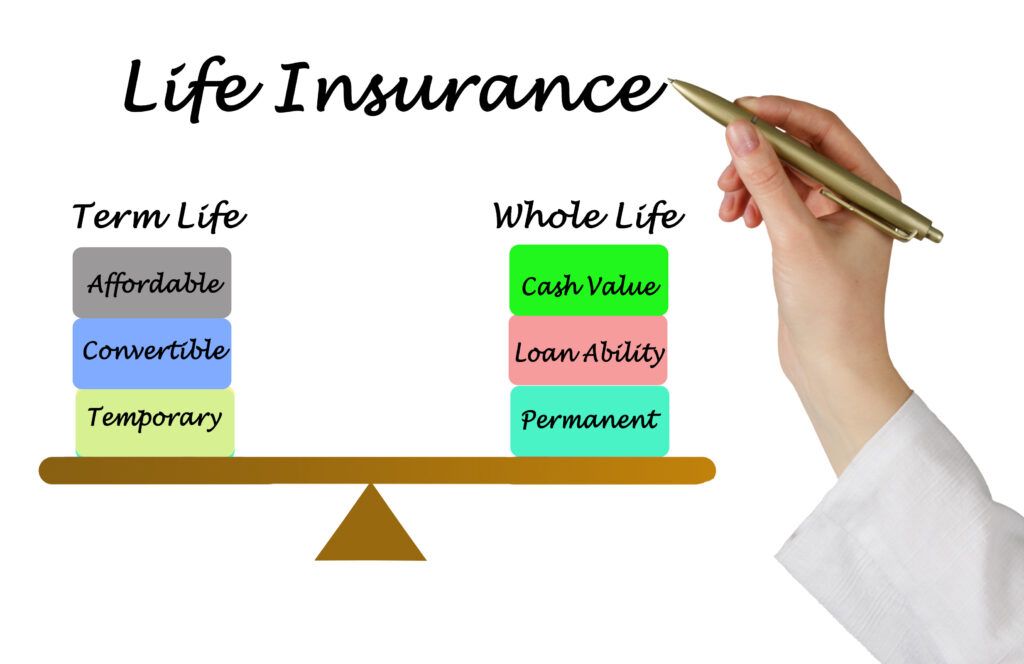

Term Life Insurance vs Whole Life

Kent A. Bennett & Associates Explains the Differences Term life insurance offers affordable coverage for a set period with no cash value, while whole life insurance provides lifelong protection and builds cash value. Read on to learn which option suits your needs. Understanding Term Life Insurance When it comes to term life insurance vs. […]

Original Medicare vs. Advantage Plans

Kent A. Bennett & Associates Explains the Differences When considering health coverage for retirement, understanding the differences between Original Medicare and Medicare Advantage plans is crucial. Keep reading to learn how to make the best choice to suit your needs. The Basics of Original Medicare Original Medicare consists of Part A (hospital insurance) and […]

Understanding Life Insurance for Children

Kent A. Bennett & Associates Discusses Life Insurance for Children Understanding life insurance for children is a topic that raises mixed feelings. It seems unusual to associate such a heavy concept with young ones, yet there are tangible benefits to consider. As a trusted insurance and investment agency in Montoursville, PA, we explore why some […]

CDs vs. Indexed Annuities

Kent A. Bennett & Associates Helps You Choose the Right Option Choosing the right financial tools for retirement can feel overwhelming. CDs and indexed annuities are two common choices. We can help you make an informed decision that aligns with your retirement goals. CDs: Safe and Predictable CDs vs. indexed annuities: each serve different financial […]

Understanding the 401(k) Rollover Process

401(k) Rollovers Made Easy with Kent A. Bennett & Associates Rolling over a 401(k) is a strategic way to manage your retirement funds, especially when changing jobs or nearing retirement. Kent A. Bennett & Associates offers guidance on the rollover process to ensure your money stays safe and continues to grow. Seamlessly Transfer Your 401(k) […]