Kent A. Bennett & Associates Explains the Differences

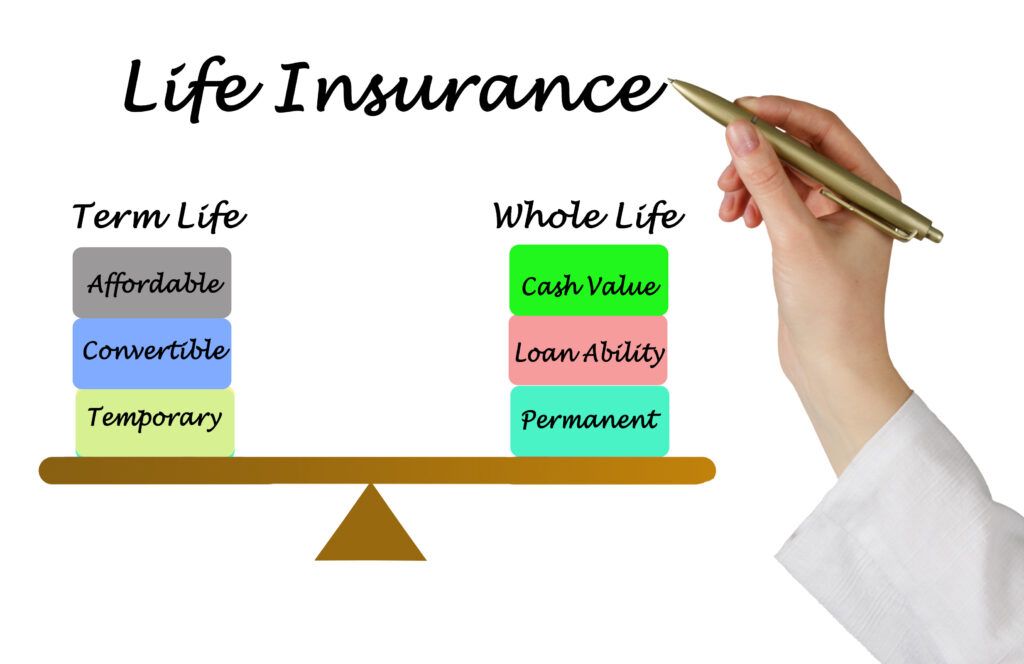

Term life insurance offers affordable coverage for a set period with no cash value, while whole life insurance provides lifelong protection and builds cash value. Read on to learn which option suits your needs.

Understanding Term Life Insurance

When it comes to term life insurance vs. whole life, term life is a straightforward and affordable option for many. It offers coverage for a specified period, ranging from 10 to 30 years. This policy is designed to provide a death benefit to beneficiaries if the insured passes away during the term. The simplicity and affordability make it an attractive choice for anyone seeking financial security during critical life stages.

Key Benefits of Term Life Insurance

With term life insurance, you get a significant coverage amount for a relatively low premium. However, it does not build cash value or offer any investment component. When the term ends, the policyholder can renew it or choose a different coverage strategy. It’s perfect for those who need substantial coverage without the long-term commitment.

Kent A. Bennett & Associates Explores Whole Life Insurance

Another difference with term life insurance vs. whole life, whole life offers a different set of benefits, designed for those seeking a permanent solution with additional financial advantages. Unlike term life insurance, whole life covers you for your entire life, as long as you continue paying the premiums. This coverage brings peace of mind, knowing that their loved ones will receive a death benefit regardless of when they pass away.

The Cash Value Advantage of Whole Life Insurance

Whole life insurance includes a cash value component, which grows over time with interest. This cash value can be accessed during the policyholder’s lifetime, offering flexibility in financial planning. Policyholders can borrow against it or even use it to pay premiums. However, these benefits come at a higher premium, making it a significant long-term investment.

The choice between term life insurance and whole life insurance depends on your financial goals, budget, and coverage needs. For an affordable solution with substantial coverage for a set period, term life insurance may be the best fit. For a permanent policy with added cash value, whole life insurance could be the right choice.

Contact Kent A. Bennett & Associates at (570) 327-1006 to find the best life insurance policy for your unique needs. Follow us on Facebook for tips and information. We are glad to help you in choosing between term life insurance vs. whole life.